Best Personal Loans For Fair Credit Of 2025

.eat-widget-container{border:1px solid #ededed;border-radius:.5rem;box-shadow:0 6px 9px rgba(0,0,0,.06);margin:20px 0;padding:16px}.eat-widget-container .eat-header{display:flex;font-family:EuclidCircularB,sans-serif;font-size:16px;font-weight:600;line-height:22px;padding-right:48px;word-break:break-word}.eat-widget-container .eat-header h2{border-style:none;margin:0;padding:0}.eat-widget-container .eat-header .eat-heading{color:#181716;font-weight:600;line-height:22px;margin:0 0 0 8px}.eat-widget-container .eat-header p.eat-heading{font-size:20px}@media (min-width:1025px){.eat-widget-container .eat-header p.eat-heading{font-size:24px}}.eat-widget-container .eat-header .eat-forbes-icon{flex-shrink:0;margin-top:2px}@media (min-width:768px){.eat-widget-container .eat-header .eat-forbes-icon{margin-top:1px}}.eat-widget-container .eat-wrapper{display:flex;flex-direction:column;padding-bottom:4px;padding-top:10px}.eat-widget-container .eat-wrapper h2{border-style:none}.eat-widget-container .eat-wrapper p{font-family:Georgia,serif;font-size:16px;line-height:26px}.eat-widget-container .eat-wrapper p:last-child{margin-bottom:0}@media (min-width:1024px){.eat-widget-container .eat-wrapper{flex-direction:row}.eat-widget-container .eat-wrapper.left-section-enabled .left-section,.eat-widget-container .eat-wrapper.right-section-enabled .right-section{width:100%}.eat-widget-container .eat-wrapper.right-section-enabled.left-section-enabled .left-section{width:60%}.eat-widget-container .eat-wrapper.left-section-enabled.right-section-enabled .right-section{padding-left:17px;width:40%}}.eat-widget-container .eat-wrapper ol{list-style-position:outside;list-style-type:decimal;margin-bottom:16px}.eat-widget-container .eat-wrapper ol:last-child{margin-bottom:0}.eat-widget-container .eat-wrapper ol li{font-size:14px;line-height:21px;margin-bottom:12px}.eat-widget-container .eat-wrapper ol li:last-child{margin-bottom:0}.eat-widget-container .eat-wrapper ul{margin:0 0 16px}.eat-widget-container .eat-wrapper ul:last-child{margin-bottom:0}.eat-widget-container .eat-wrapper ul li{font-family:EuclidCircularB,sans-serif;font-size:14px;line-height:21px;list-style-type:none;margin-bottom:12px;padding-left:27px;position:relative}.eat-widget-container .eat-wrapper ul li:last-child{margin-bottom:0}.eat-widget-container .eat-wrapper ul li:before{background:url(“data:image/svg+xml;charset=utf-8,%3Csvg width=’17’ height=’17’ fill=’none’ xmlns=’http://www.w3.org/2000/svg’%3E%3Cg clip-path=’url(%23a)’%3E%3Cpath d=’M15.583 7.852v.652a7.083 7.083 0 1 1-4.2-6.474m4.2.803L8.5 9.923 6.375 7.8′ stroke=’%237894D6′ stroke-width=’2′ stroke-linecap=’round’ stroke-linejoin=’round’/%3E%3C/g%3E%3Cdefs%3E%3CclipPath id=’a’%3E%3Cpath fill=’%23fff’ d=’M0 0h17v17H0z’/%3E%3C/clipPath%3E%3C/defs%3E%3C/svg%3E”) no-repeat;content:””;display:inline-block;height:20px;left:0;position:absolute;right:0;top:2px;width:20px}.eat-widget-container .eat-wrapper .left-section{order:2}@media (min-width:1024px){.eat-widget-container .eat-wrapper .left-section{order:0}}.eat-widget-container .eat-wrapper .right-section{flex-shrink:0;margin-bottom:16px;order:1;word-break:break-word}@media (min-width:1024px){.eat-widget-container .eat-wrapper .right-section{margin-bottom:0;order:0;padding-bottom:0}}.eat-widget-container .eat-wrapper a,.eat-widget-container .eat-wrapper b,.eat-widget-container .eat-wrapper em,.eat-widget-container .eat-wrapper i,.eat-widget-container .eat-wrapper span,.eat-widget-container .eat-wrapper strong{font-family:inherit;font-size:inherit;line-height:inherit}.eat-widget-container .eat-wrapper b,.eat-widget-container .eat-wrapper strong{font-weight:600}.eat-widget-container .eat-header-wrap{cursor:pointer;position:relative}.eat-widget-container .eat-header-wrap:after{background:url(“data:image/svg+xml;charset=utf-8,%3Csvg width=’20’ height=’20’ fill=’none’ xmlns=’http://www.w3.org/2000/svg’%3E%3Cpath fill-rule=’evenodd’ clip-rule=’evenodd’ d=’M15.838 0H4.162c-.527 0-.981 0-1.356.03-.395.033-.789.104-1.167.297A3 3 0 0 0 .327 1.638c-.193.378-.264.772-.296 1.167C0 3.18 0 3.635 0 4.161V15.84c0 .527 0 .981.03 1.356.033.395.104.789.297 1.167a3 3 0 0 0 1.311 1.311c.378.193.772.264 1.167.296.375.031.83.031 1.356.031H15.84c.527 0 .981 0 1.356-.03.395-.033.789-.104 1.167-.297a3 3 0 0 0 1.311-1.311c.193-.378.264-.772.296-1.167.031-.375.031-.83.031-1.356V4.16c0-.527 0-.981-.03-1.356-.033-.395-.104-.789-.297-1.167A3 3 0 0 0 18.362.327c-.378-.193-.772-.264-1.167-.296A17.9 17.9 0 0 0 15.838 0ZM10 5a1 1 0 0 1 1 1v3h3a1 1 0 1 1 0 2h-3v3a1 1 0 1 1-2 0v-3H6a1 1 0 1 1 0-2h3V6a1 1 0 0 1 1-1Z’ fill=’%2344549C’/%3E%3C/svg%3E”) no-repeat;content:””;display:inline-block;height:20px;position:absolute;right:0;top:10px;transform:translateY(-50%);transition:all .3s ease;width:20px}.eat-widget-container .eat-header-wrap.active:after{background:url(“data:image/svg+xml;charset=utf-8,%3Csvg width=’20’ height=’20’ fill=’none’ xmlns=’http://www.w3.org/2000/svg’%3E%3Cpath fill-rule=’evenodd’ clip-rule=’evenodd’ d=’M15.838 0H4.162c-.527 0-.981 0-1.356.03-.395.033-.789.104-1.167.297A3 3 0 0 0 .327 1.638c-.193.378-.264.772-.296 1.167C0 3.18 0 3.635 0 4.161V15.84c0 .527 0 .981.03 1.356.033.395.104.789.297 1.167a3 3 0 0 0 1.311 1.311c.378.193.772.264 1.167.296.375.031.83.031 1.356.031H15.84c.527 0 .981 0 1.356-.03.395-.033.789-.104 1.167-.297a3 3 0 0 0 1.311-1.311c.193-.378.264-.772.296-1.167.031-.375.031-.83.031-1.356V4.16c0-.527 0-.981-.03-1.356-.033-.395-.104-.789-.297-1.167A3 3 0 0 0 18.362.327c-.378-.193-.772-.264-1.167-.296A17.9 17.9 0 0 0 15.838 0ZM6 9a1 1 0 0 0 0 2h8a1 1 0 1 0 0-2H6Z’ fill=’%2344549C’/%3E%3C/svg%3E”) no-repeat}.edit-eat-widget{margin:0 0 10px}@media (min-width:768px){.page-template .eat-widget-container:has(.eat-header-wrap.active),.post-template .eat-widget-container:has(.eat-header-wrap.active),.post-template-default .eat-widget-container:has(.eat-header-wrap.active){padding-bottom:24px}}.page-template .eat-widget-container .eat-header-wrap:after,.post-template .eat-widget-container .eat-header-wrap:after,.post-template-default .eat-widget-container .eat-header-wrap:after{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMjAiIGhlaWdodD0iMjAiIGZpbGw9Im5vbmUiIHhtbG5zPSJodHRwOi8vd3d3LnczLm9yZy8yMDAwL3N2ZyI+PHBhdGggZmlsbC1ydWxlPSJldmVub2RkIiBjbGlwLXJ1bGU9ImV2ZW5vZGQiIGQ9Ik0xNS44MzggMEg0LjE2MmMtLjUyNyAwLS45ODEgMC0xLjM1Ni4wMy0uMzk1LjAzMy0uNzg5LjEwNC0xLjE2Ny4yOTdBMyAzIDAgMCAwIC4zMjcgMS42MzhjLS4xOTMuMzc4LS4yNjQuNzcyLS4yOTYgMS4xNjdDMCAzLjE4IDAgMy42MzUgMCA0LjE2MVYxNS44NGMwIC41MjcgMCAuOTgxLjAzIDEuMzU2LjAzMy4zOTUuMTA0Ljc4OS4yOTcgMS4xNjdhMyAzIDAgMCAwIDEuMzExIDEuMzExYy4zNzguMTkzLjc3Mi4yNjQgMS4xNjcuMjk2LjM3NS4wMzEuODMuMDMxIDEuMzU2LjAzMUgxNS44NGMuNTI3IDAgLjk4MSAwIDEuMzU2LS4wMy4zOTUtLjAzMy43ODktLjEwNCAxLjE2Ny0uMjk3YTMgMyAwIDAgMCAxLjMxMS0xLjMxMWMuMTkzLS4zNzguMjY0LS43NzIuMjk2LTEuMTY3LjAzMS0uMzc1LjAzMS0uODMuMDMxLTEuMzU2VjQuMTZjMC0uNTI3IDAtLjk4MS0uMDMtMS4zNTYtLjAzMy0uMzk1LS4xMDQtLjc4OS0uMjk3LTEuMTY3YTMgMyAwIDAgMC0xLjMxMi0xLjMxYy0uMzc4LS4xOTMtLjc3Mi0uMjY0LTEuMTY3LS4yOTZBMTcuOSAxNy45IDAgMCAwIDE1LjgzOCAwWk0xMCA1YTEgMSAwIDAgMSAxIDF2M2gzYTEgMSAwIDEgMSAwIDJoLTN2M2ExIDEgMCAwIDEtMiAwdi0zSDZhMSAxIDAgMCAxIDAtMmgzVjZhMSAxIDAgMCAxIDEtMVoiIGZpbGw9IiMwMDdBQzgiLz48L3N2Zz4=”) no-repeat}.page-template .eat-widget-container .eat-header-wrap.active:after,.post-template .eat-widget-container .eat-header-wrap.active:after,.post-template-default .eat-widget-container .eat-header-wrap.active:after{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMjAiIGhlaWdodD0iMjAiIGZpbGw9Im5vbmUiIHhtbG5zPSJodHRwOi8vd3d3LnczLm9yZy8yMDAwL3N2ZyI+PHBhdGggZmlsbC1ydWxlPSJldmVub2RkIiBjbGlwLXJ1bGU9ImV2ZW5vZGQiIGQ9Ik0xNS44MzguNUg0LjE2MmMtLjUyNyAwLS45ODEgMC0xLjM1Ni4wMy0uMzk1LjAzMi0uNzg5LjEwMy0xLjE2Ny4yOTZBMyAzIDAgMCAwIC4zMjcgMi4xMzdjLS4xOTMuMzc4LS4yNjQuNzcyLS4yOTYgMS4xNjdDMCAzLjY4IDAgNC4xMzQgMCA0LjY2djExLjY4YzAgLjUyNiAwIC45OC4wMyAxLjM1NS4wMzMuMzk1LjEwNC43OS4yOTcgMS4xNjdhMyAzIDAgMCAwIDEuMzExIDEuMzExYy4zNzguMTkzLjc3Mi4yNjQgMS4xNjcuMjk2LjM3NS4wMzEuODMuMDMxIDEuMzU2LjAzMUgxNS44NGMuNTI3IDAgLjk4MSAwIDEuMzU2LS4wMy4zOTUtLjAzMy43ODktLjEwNCAxLjE2Ny0uMjk3YTMgMyAwIDAgMCAxLjMxMS0xLjMxYy4xOTMtLjM3OS4yNjQtLjc3My4yOTYtMS4xNjguMDMxLS4zNzUuMDMxLS44My4wMzEtMS4zNTZWNC42NmMwLS41MjcgMC0uOTgtLjAzLTEuMzU2LS4wMzMtLjM5NS0uMTA0LS43ODktLjI5Ny0xLjE2N2EzIDMgMCAwIDAtMS4zMTItMS4zMUMxNy45ODQuNjMzIDE3LjU5LjU2MiAxNy4xOTUuNTNBMTcuOSAxNy45IDAgMCAwIDE1LjgzOC41Wk0xMCA5LjQ5OGwuNS4wMDFIMTRhMSAxIDAgMSAxIDAgMmgtNGwtLjUtLjAwMUg2YTEgMSAwIDAgMSAwLTJoM2wuMDIzLjAwMUg5LjVMMTAgOS41WiIgZmlsbD0iIzAwN0FDOCIvPjwvc3ZnPg==”) no-repeat}.page-template .eat-widget-container .eat-header,.post-template .eat-widget-container .eat-header,.post-template-default .eat-widget-container .eat-header{font-family:Work Sans,sans-serif}.page-template .eat-widget-container .eat-header .eat-forbes-icon,.post-template .eat-widget-container .eat-header .eat-forbes-icon,.post-template-default .eat-widget-container .eat-header .eat-forbes-icon{margin-top:-1px}@media (min-width:768px){.page-template .eat-widget-container .eat-header .eat-forbes-icon,.post-template .eat-widget-container .eat-header .eat-forbes-icon,.post-template-default .eat-widget-container .eat-header .eat-forbes-icon{margin-top:-1px}}.page-template .eat-widget-container .eat-header .eat-heading,.post-template .eat-widget-container .eat-header .eat-heading,.post-template-default .eat-widget-container .eat-header .eat-heading{color:#333}.page-template .eat-widget-container .eat-wrapper,.post-template .eat-widget-container .eat-wrapper,.post-template-default .eat-widget-container .eat-wrapper{padding-bottom:0}.page-template .eat-widget-container .eat-wrapper ul li,.post-template .eat-widget-container .eat-wrapper ul li,.post-template-default .eat-widget-container .eat-wrapper ul li{font-family:Work Sans,sans-serif}.page-template .eat-widget-container .eat-wrapper ul li:before,.post-template .eat-widget-container .eat-wrapper ul li:before,.post-template-default .eat-widget-container .eat-wrapper ul li:before{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMTgiIGhlaWdodD0iMTgiIGZpbGw9Im5vbmUiIHhtbG5zPSJodHRwOi8vd3d3LnczLm9yZy8yMDAwL3N2ZyI+PHBhdGggZD0iTTEzLjI3NyA3LjI2NWEuNzM1LjczNSAwIDEgMC0xLjA0LTEuMDM5bC0zLjk4OCAzLjk5LTIuNDg2LTIuNDg3YS43MzUuNzM1IDAgMSAwLTEuMDQgMS4wNGwzLjAwNiAzLjAwNWEuNzM1LjczNSAwIDAgMCAxLjA0IDBsNC41MDgtNC41MDlaIiBmaWxsPSIjMDA3QUM4Ii8+PHBhdGggZmlsbC1ydWxlPSJldmVub2RkIiBjbGlwLXJ1bGU9ImV2ZW5vZGQiIGQ9Ik05IDBhOSA5IDAgMSAwIDAgMThBOSA5IDAgMCAwIDkgMFpNMS40NyA5YTcuNTMgNy41MyAwIDEgMSAxNS4wNiAwQTcuNTMgNy41MyAwIDAgMSAxLjQ3IDlaIiBmaWxsPSIjMDA3QUM4Ii8+PC9zdmc+”) no-repeat}

Best Personal Loans for Fair Credit of 2025

Summary: Best Personal Loans for Fair Credit of 2025

| COMPANY | FORBES ADVISOR RATING | MINIMUM CREDIT SCORE | APR RANGE | LOAN AMOUNTS | LEARN MORE |

|---|---|---|---|---|---|

600 | 7.99% to 35.99% | $1,000 to $36,500 | Via MoneyLion’s Website | ||

OneMain Financial does not disclose this information | 18.00% to 35.99% | $1,500 to $20,000 | Via Credible.com’s Website | ||

620 | 7.99% to 35.99% | $1,000 to $50,000 | Via Credible.com’s Website | ||

600 | 7.90% to 35.99% | $1,000 to $40,000 | Via Credible.com’s Website | ||

660 | 6.49% to 25.29% | $5,000 to $100,000 | Via Credible.com’s Website | ||

650 | 8.99% to 35.49% with all discounts | $5,000 to $100,000 | Via Credible.com’s Website | ||

550 | 9.95% to 35.99% | $2,000 to $35,000 | Via Credible.com’s Website | ||

620 | 6.70% to 35.99% | $1,000 to $50,000 | Via Credible.com’s Website |

How To Compare Personal Loans for Fair Credit

Most lenders disclose the information you need to compare your loan options on their website, including loan terms, interest rates, fees and, in some cases, even qualification requirements. However, prequalifying for loan offers can give you a better idea of the rates and terms lenders may offer you without impacting your credit.

Once you’re ready to compare loan offers, consider these loan features:

- Annual percentage rate (APR). APR is the total cost of borrowing money, including interest and fees. Comparing your APR offers can be the most efficient way to find the lowest-cost option. Other loan features are also essential to consider.

- Loan terms. Each lender offers different loan terms or the time you have to repay a loan. The loan terms influence your monthly payment. Before you accept a loan, be sure you can afford to repay the loan on time.

- Loan amounts. If you have fair credit and need a large loan, some lenders may not offer you the full amount. If this is the case, you can narrow down your options depending on where you can get a sufficient loan amount.

- Qualification requirements. If you’re applying for personal loans with fair credit, you likely won’t be able to qualify with just any lender. Before applying, be sure you meet the lender’s minimum qualification requirements.

- Fees and penalties. Fees and penalties, including origination fees, prepayment penalties and late payment fees, vary between lenders. If, for instance, you plan to repay your loan early, look for lenders that charge no prepayment penalties.

- Perks. Some lenders offer perks, such as discounts for automatic payments or payment deferral if you need forbearance. Consider whether you would use these features when comparing your loan options.

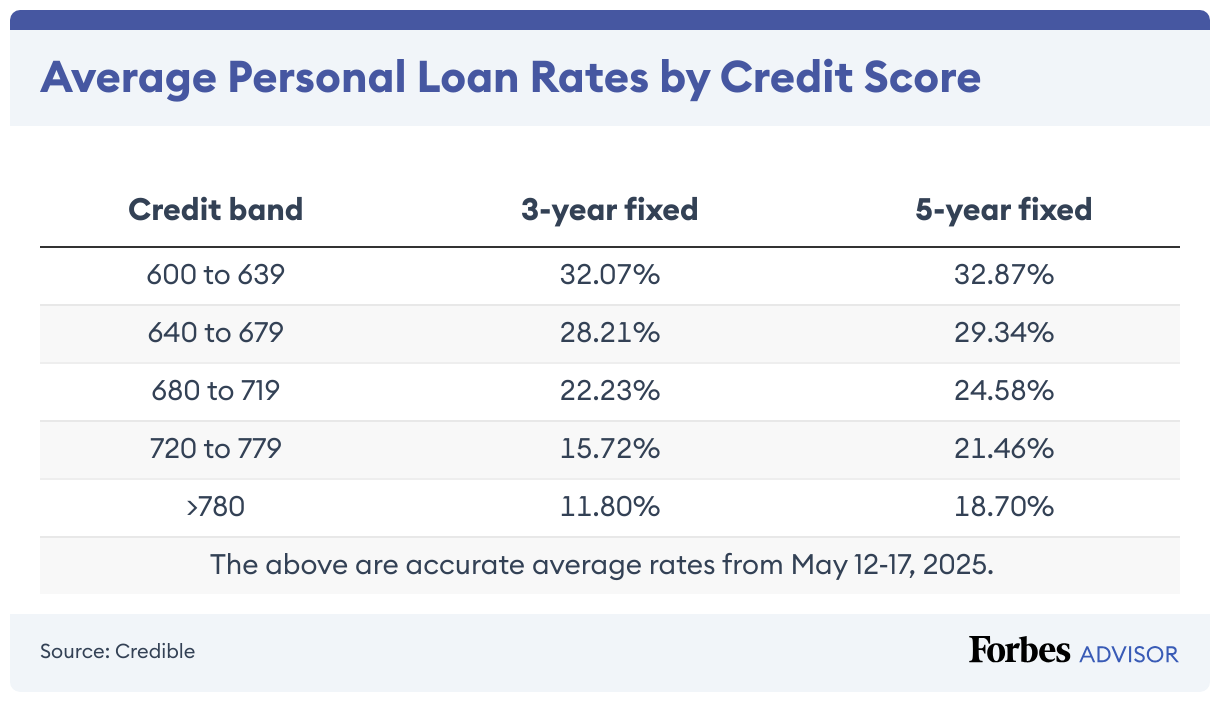

How Does Fair Credit Impact Interest Rates?

Most lenders use your score to help determine your ability to manage debt. If you have fair credit (580 to 669 on the FICO scale), it can be challenging to qualify for a lender’s lowest advertised interest rates.

Nonetheless, your credit score is just one part of a loan application. Maintaining a high income or a small amount of debt compared to your income—represented as your debt-to-income (DTI) ratio—can help you qualify for lower rates.

If your application is denied, you’ll receive an adverse action letter explaining the rejection. It can be worthwhile to address the issues noted in the letter before applying for other loans, which may also help you receive lower interest rates.

Average Personal Loan Rates By Credit Score

How To Qualify for the Lowest Possible Rates

Fair credit can make it hard to get the lowest advertised rates, but there are steps you can take to receive lower rates, including:

- Improve your credit. You can quickly improve your credit by paying down debts to reduce your credit utilization rate, requesting higher credit limits and correcting any errors on your credit report. If you increase your credit limit, be sure not to use it or your credit utilization rate will increase, which may harm your credit score.

- Lower your DTI. Paying down debt (or increasing your income) can reduce your DTI. Lenders use your DTI to determine your ability to repay a loan.

- Shop around. Considering a wide range of lenders, including credit unions and online lenders, can help you find the lowest interest rates. Compare prequalification offers to determine which lender is best.

Alternatives to a Fair Credit Loan

If your credit score is sufficient, there are alternatives you can consider, including:

- Secured personal loans. With a secured personal loan, borrowers offer up collateral to back the cost of the loan. Secured loans can be easier to qualify for because if you fail to repay the loan, the lender can take possession of your collateral.

- Home equity financing. Home equity loans or lines of credit use the equity you’ve built in your home to get funding. These loans may come with lower interest rates than personal loans. However, because your home secures the loan, the lender can repossess your home if you fail to repay.

- Credit cards. If you need to cover a short-term financial emergency, credit cards can be an effective tool if you have a plan to repay your debt. Keep in mind, it can be easy to overspend on a credit card, and high APRs and fees can make carrying a balance expensive.

- Cash advance apps. Cash advance apps offer short-term loans—typically two weeks—in small amounts. These loans can be a good option to cover a small financial need, but missing payments can lead to late fees and other penalties.

- Savings. Saving to cover your expenses rather than taking out a loan will let you avoid interest and the burden of repaying a loan for years to come.

- Friends and family. If you have friends or family willing to lend you money, this can be a good option to cover your financial needs. Before accepting any funding, consider writing a promissory note so both parties agree on the loan terms.

Methodology

We reviewed 44 popular lenders based on 20 data points in the categories of customer sentiment index, loan details, loan costs, eligibility and accessibility and the application process. We chose the best lenders based on the weighting assigned to each category:

- Customer sentiment index. 40%

- Eligibility and accessibility. 25%

- Loan details. 15%

- Loan costs. 13%

- Application process. 7%

We also considered several characteristics within each major category, including available loan amounts, repayment terms, APR ranges and applicable fees. We also looked at minimum credit score requirements, whether each lender accepts co-signers or joint applications and the geographic availability of the lender. Finally, we evaluated each provider’s customer support tools, borrower perks and features that simplify the borrowing process—such as prequalification options and mobile apps.

Where appropriate, we awarded partial points depending on how well a lender met each criterion.

To learn more about how Forbes Advisor rates lenders, and our editorial process, check out our Personal Loans Rating Methodology.

Next Up In Personal Loans